Sequeira Partners Presents – Morning Brew: Insights on the M&A Front RSVP

Read More

Read More

Characterized by a diverse array of investors and positive industry dynamics that continue to drive M&A activity in the sector, our annual

Read More

Will insurance brokerage valuations continue to rise in the face of macroeconomic headwinds? Sequeira Partners continues to advise on insurance

Read More

Huge congratulations to our partner, Erica McGuinness, CPA, CA, CBV, for being honored with the Business in Vancouver (BIV News) Top

Read More

Congratulations to Sarry Mourad, CPA and Andrew Zanello, CPA, CBV. Well

Read More

Capturing Moments at Sequeira Partners 2nd Annual Women & Entrepreneurship Event in

Read More

Waste and Recycling Industry Deep Dive Building on the positive momentum of 2022, the waste and recycling sector continued to

Read More

Continued Strong Buyer Appetite Amongst Economic Headwinds Heading into 2022, the insurance brokerage sector continued to experience a high level

Read More

[EDMONTON, Alberta] June 8, 2022 – Exciting changes at Sequeira Partners! We are pleased to announce Julie Afanasiff will be

Read MoreSequeira Partners acted as the exclusive financial advisor to ZLC EBS. The Synex press release is below and the original

Read More

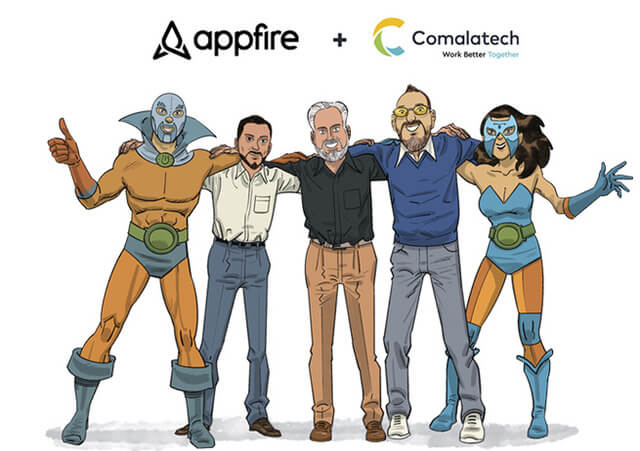

Sequeira Partners acted as the exclusive financial advisor to Comalatech. The Appfire press release is below and the original is here.

Read More

Sequeira Partners acted as the exclusive financial advisor to Barclay Insurance Services. The Sterling Capital press release is below and

Read MoreSequeira Partners acted as the exclusive financial advisor to Foster Park and its affiliates. The NFP press release is below and

Read More

[EDMONTON, Alberta] August 3, 2021 – Sequeira Partners is excited to welcome three new partners to its senior leadership team

Read MoreCharacterized by a diverse array of investors and positive industry dynamics that continue to drive M&A activity in the sector, our annual

Download PublicationWill insurance brokerage valuations continue to rise in the face of macroeconomic headwinds? Sequeira Partners continues to advise on insurance

Download PublicationDownload Quarterly Report: Value & Market Insights – Q4 2023 Download Quarterly Report: The Well Street Journal- Q4

Read MoreDownload Quarterly Report: The Well Street Journal- Q3 2023 Download Quarterly Report: Value & Market Insights – Q3

Read MoreDownload Quarterly Report: The Well Street Journal- Q2 2023 Download Quarterly Report: Value & Market Insights – Q2

Read MoreWaste and Recycling Industry Deep Dive Building on the positive momentum of 2022, the waste and recycling sector continued to

Download PublicationDownload Quarterly Report: The Well Street Journal- Q1 2023 Download Quarterly Report: Value & Market Insights – Q1

Read MoreContinued Strong Buyer Appetite Amongst Economic Headwinds Heading into 2022, the insurance brokerage sector continued to experience a high level

Download PublicationDownload Quarterly Report: The Well Street Journal– Q4 2022 Download Quarterly Report: Value & Market Insights – Q4

Read MoreDownload Quarterly Report: The Well Street Journal- Q3 2022 Download Quarterly Report: Value & Market Insights- Q3

Read MoreDownload Quarterly Report: The Well Street Journal- Q2

Read MoreDownload Quarterly Report: The Well Street Journal – Q1 2022 Download Quarterly Report– Value & Market Insight – Q1

Read MoreDownload Quarterly Report: The Well Street Journal– Q4 2021 Download Quarterly Report: Value & Market Insights –

Read MoreDownload Quarterly Report

Download PublicationCrude prices over the course of August demonstrated quite a bit of flux as concerns over the spread of the

Download PublicationDownload Quarterly Report: The Well Street Journal – Q2 2021 Download Quarterly Report: Value & Market Insights – Q2

Read MoreAs global restrictions continue to lift and economic activity ramps up, crude pricing has continued to improve. In concert with

Download PublicationDownload Quarterly Report: The Well Street Journal– Q1 2021 Download Quarterly Report: Value & Market Insights –

Read MoreFebruary was a strong month for the energy sector with higher prices driving both the Sequeira OFS index and the

Download PublicationDownload Quarterly Report: The Well Street Journal– Q4 2020 Download Quarterly Report: Value & Market Insights –

Read MoreIn a year that was like none other, many companies have had to adapt. For Sequeira Partners, this meant a

Read More